Article No. 5 - Utah's Thriving Health and Life Sciences Sector: A Leading Innovator

Utah's health and life sciences sector isn't just a growth story—it's a testament to the state's commitment to innovation, entrepreneurship, and advancing scientific progress. In recent years, Utah has emerged as a formidable player in the biotech arena, driven by a combination of talent, research, and a supportive ecosystem.

A decade of rapid growth

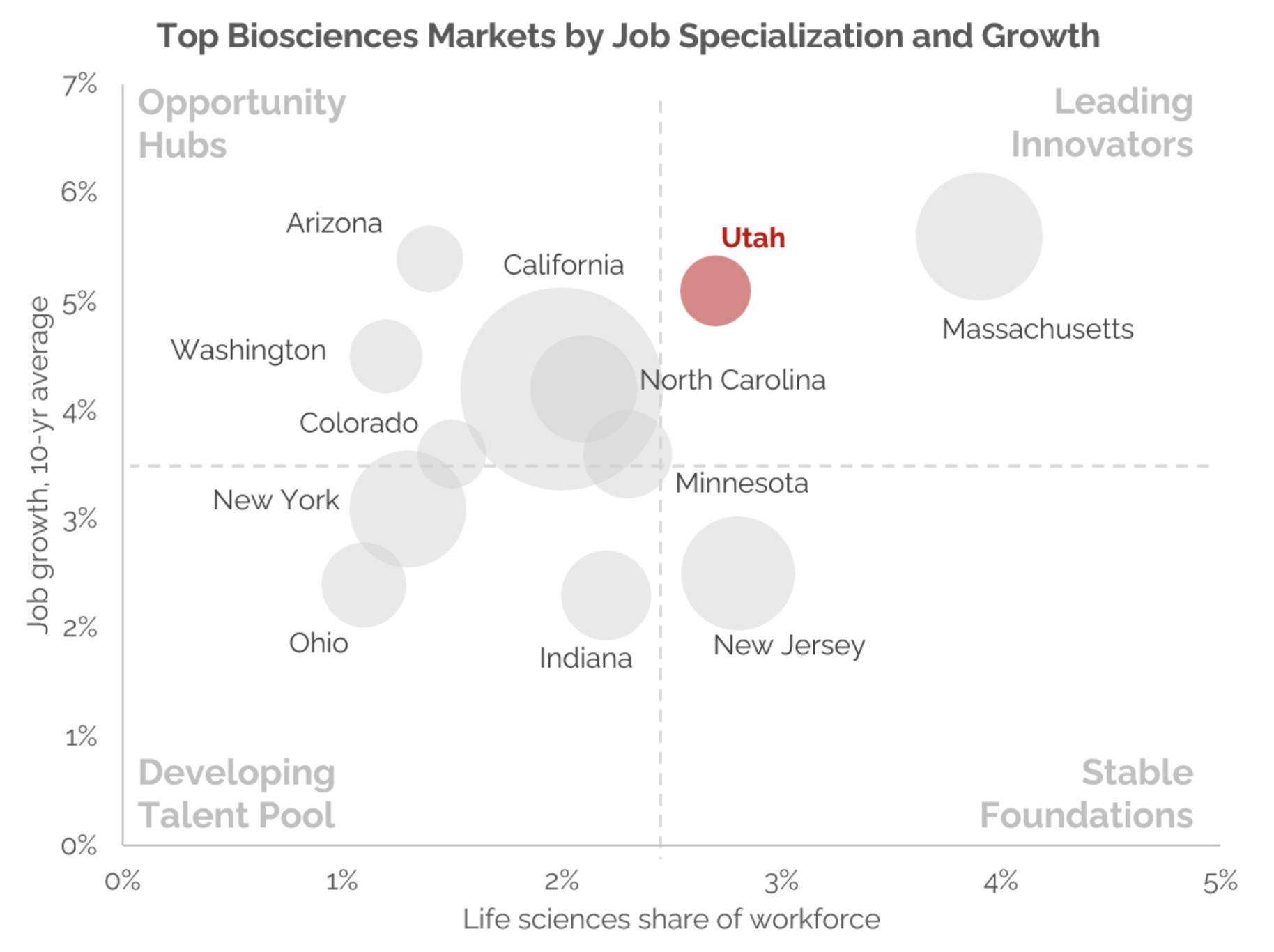

Utah’s life sciences sector has experienced impressive growth, positioning itself as the third-fastest-growing market in the field with a 10-year average growth rate of 5.1%2. This rapid growth surpasses the national average of 3.5% and places it just behind leading Massachusetts and Arizona, outpacing even the dominant force of California’s life sciences sector. While lacking the same level of public attention as Utah's tech industry, the life sciences sector in Utah has made powerful strides, contributing significantly to the state's economic vitality. This growth is underscored by key milestones that have shaped Utah's biosciences industry over the past decade.

One such milestone is Utah's life sciences landscape evolving beyond its traditional focus on medical device manufacturing5. While medical devices remain foundational to Utah's ecosystem, the state has diversified its portfolio to encompass diagnostics, research and development, and digital health innovations. This multifaceted approach has positioned Utah as a well-rounded player, capable of driving innovation across various subsectors.

The COVID-19 pandemic also served as a catalyst for growth and visibility within Utah's life sciences industry5. COVID-19 brought increased exposure to the industry, leading to greater visibility and financial stability for many companies. Additionally, the pandemic accelerated trends such as remote work and digital health, further bolstering Utah's position as a hub for innovation and talent.

Specialization and expertise

What sets Utah apart is its high concentration of the workforce in the life sciences sector. With 2.7% of the state's workforce dedicated to life sciences—more than double the average across other industries—Utah has firmly established itself as a specialized player in the field. This concentration of talent and expertise has been steadily on the rise, climbing from 2.4% in 2013. Notably, Utah ranks third in the nation for the proportion of employees engaged in the industry, trailing behind only Massachusetts and New Jersey2.

Utah's specialized workforce is amplified by its robust pipeline of professionals educated in Science, Technology, Engineering, and Math (STEM) fields. Over the past two decades, Utah's colleges and universities have witnessed a significant surge in STEM degree completions, with annual completions rising from 2,371 in 2000 to 7,562 in 2021—an average increase of 5.7% per year. This surge in STEM graduates has contributed to a highly specialized workforce, well-equipped to meet the demands of life sciences companies. In 2021 alone, three universities—University of Utah, Utah State University, and Utah Valley University—awarded a combined total of 5,944 STEM degrees, accounting for 78.6% of the total STEM degrees conferred by Utah's eight public colleges and universities2. As Utah continues to foster a culture of academic excellence and innovation, its specialized workforce remains a driving force behind the state's thriving life sciences industry. This specialization serves as a magnet for top-tier talent and innovative companies.

A leader in the industry

Thanks to its robust job growth and a concentrated workforce, Utah emerges as a "Leading Innovator" among top biosciences markets.

Note: Size of circles corresponds to life sciences market size by employment. Selected markets chosen from top 20 states by specialization and growth

Source: Do Good analysis of data from the Bio Council of State Bioscience Association1 and the Kem C. Gardner Policy Institute2

Utah's rapid growth and specialization in the health and life sciences industry rivals that of Boston, Massachusetts, a market renowned globally as a long-standing hub of innovation and excellence in the field. If historical trends in job expansion and workforce concentration continue, Utah is poised to reach further innovative heights comparable to the reigning Boston/Cambridge market. The state shares several criteria for industry growth with Massachusetts, setting it on a path to success:

Specialization: Utah is one of only eight states with a critically high location quotient, measuring industrial specialization in a market, in three different health and life sciences subsectors. These include Pharmaceuticals, Medical devices and equipment, and Research, testing, and laboratories. Massachusetts is specialized in only two of those sectors (Medical devices and equipment, and Research, testing, and laboratories), with several more earning concentrated status3.

Tax incentives: Utah’s state tax incentives for industry development align with those of Massachusetts, including SBIR State Matching Grants, a manufacturing sales tax exemption on equipment, a research and development (R&D) tax credit for product development, and angel funding for emerging companies1. These tax incentives reduce the financial risks that come with research and development and manufacturing in the industry and are an important component to building and growing a thriving health and life sciences industry hub in Utah.

Private and public support: Both Utah and Massachusetts have a strong ecosystem of government, private sector, and academia. The presence of leading research universities such as the state’s flagship University of Utah, industry collectives such as BioHive, and a business friendly regulatory body are working together to push industry growth in the state. This vibrant community fosters collaboration and is a mark of a leading industry in the nation.

Private sector investments: While Massachusetts receives more life sciences venture capital (VC) funding than any other state, Utah has made remarkable progress in attracting private sector investments. Ranking eighth nationally in per capita VC investment in life science companies from 2018 to 2021, with $678 invested per capita, Utah showcases its growing appeal to investors. Although Massachusetts maintains formidable dominance in life sciences VC funding, with $5963 invested per capita and $79 billion in total VC funding, Utah's place in the top 10 markets by per capita investment signals its potential to bridge the difference and attract more investments in the future1.

NIH funding potential: While Utah's growth in the life sciences sector is impressive, there remains untapped potential in securing funding from the National Institutes of Health (NIH), which supports innovative ventures and biomedical research. Currently ranked 21st in the nation for NIH funding at a comparatively modest $86 per capita, supporting only 649 projects, Utah has room to increase its NIH funding allocation. In comparison, Massachusetts received $501 per capita for 5920 projects in 20234. Despite this funding gap, Utah's trajectory indicates a promising future of growth and innovation within the bioscience sector as it leads the nation alongside the reigning Boston market.

A vision for the future

As Governor Spencer Cox has said, “Life sciences have become a strategic pillar of Utah’s economy. The industry embodies entrepreneurship and innovation in its work to improve and save lives through advanced testing, novel technologies, and groundbreaking cures1.” Utah's trajectory in the health and life sciences industry is not just a success story—it's a testament to the state's unwavering commitment to improving lives and shaping the future of biotech innovation. With each passing year, Utah's influence in the global biotech landscape grows stronger, fueled by a shared vision of addressing the world's most pressing challenges. As Utah continues to chart its course forward, one thing is clear: the best is yet to come.

Utah's trajectory in the health and life sciences industry is a testament to the state's commitment to improving lives and shaping the future of biotech innovation. Each year, Utah's influence in the global biotech landscape strengthens, fueled by a vision of solving the world's toughest challenges. This momentum was recently featured at BioHive Live, Utah's Life Sciences and Healthcare Innovation Event, is a forward-thinking platform uniting industry leaders and disruptors to elevate Utah’s life sciences community.

Sources:

Bio Council of State Bioscience Association. (2023). The U.S. Biosciences Industry in the States: Best Practices in Innovation, Partnerships, and Job Creation.

Kem C Gardner Policy Institute. (2023, November). Economic Impacts of Utah’s Life Sciences and Health Care Innovation Industry (Report No. 123). Levi Pace, Ph.D. & Andrea Thomas Brandley (Eds.).

TEConomy/Bio. (2022). The U.S. Bioscience Industry: Fostering Innovation and Driving America’s Economy Forward.

U.S. Department of Health and Human Services. (2023). NIH Awards by Location & Organization.

Withers Taylor, Savannah Beth (2024, March 13). Roundtable: Utah’s Evolving Life Sciences Industry. Utah Business