Western Economic Reset: A Perfect [Fire]Storm Brewing?

Contributing a chapter to the 2025 Economic Report to the Governor of Utah was an honor, especially as a member of the Utah Economic Council and someone who studies the economy through the lens of Do Good. My work focuses on understanding how local, state, regional, federal, and international factors shape Utah’s unique economic landscape. Utah’s strength as a national leader in growth and resilience offers a foundation of optimism, but as we step into 2025, it’s clear that addressing challenges like housing affordability and managing the ripple effects of regional events, such as the California wildfires, will be critical to sustaining our progress.

At the core lies that the California wildfires are estimated to cause $135-$150 billion in total economic losses, with insured losses projected to exceed $8 billion, according to Accuweather and analysts from Morningstar and JP Morgan.

This trend is likely to persist, as many of the homes served not only as shelter but also as repositories for valuable artwork and intangible assets. These elements are poised to disrupt the economy more significantly than a typical disaster would.

The devastation, impacting some of the nation’s most expensive real estate, underscores the growing financial strain of climate-related risks on both homeowners and the insurance industry. But the real concern isn't just the scale—it's the cascading effects reshaping our economic landscape. Major insurers are exiting the California market, creating ripples of uncertainty that extend far beyond state lines. This insurance exodus represents a fundamental shift in how risk is assessed and managed across the entire region.

The numbers paint a stark picture: over 112,000 displaced residents, 10,000 destroyed structures in California alone, and a wave of migration affecting neighboring states like Utah, which just surpassed 3.5 million residents. While Utah leads the nation with 4.6% GDP growth, these very strengths could make it particularly susceptible to regional economic shocks.

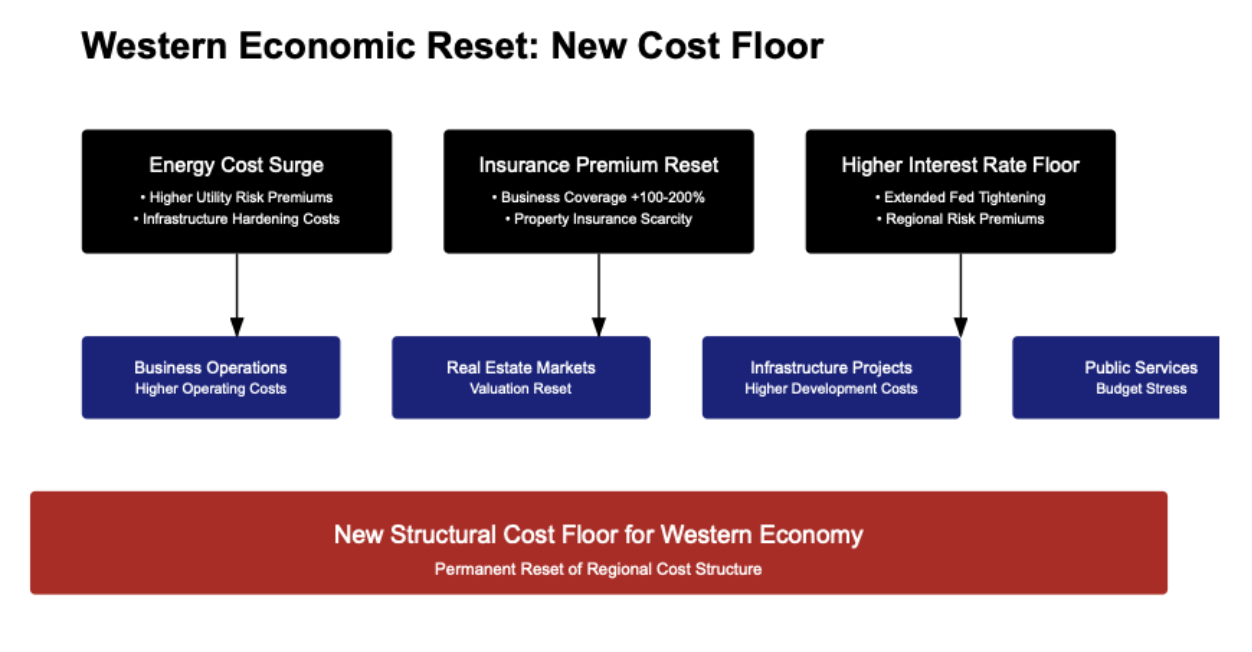

Three critical factors are creating a new, higher cost floor for the entire Western economy:

Insurance Market Disruption: Business insurance premiums are rising substantially, property insurance is becoming scarce or unavailable, risk-coverage gaps are forcing changes to business models, and higher operating costs are impacting all sectors.

Energy and Infrastructure Costs: Utility risk premiums from wildfire liability, infrastructure hardening requirements, higher transmission and distribution costs, and grid reliability investments are driving up energy expenses across the region. All while record demand is placed on the grid.

Extended High Interest Rates: California, representing 15% of the U.S. economy and home to Los Angeles, the nation’s fourth-largest metropolitan area, faces significant economic risks. Regional inflation, higher borrowing costs, municipal bond market stress, and capital access constraints are compounding pressures, while potential disruptions to vital ports in Los Angeles could further strain supply chains and trade flows across the country.

This convergence is creating amplifying feedback loops that traditional economic models struggle to capture. For example, as insurance costs rise, businesses face higher operating expenses, leading to increased prices and wages. This regional inflation pressure keeps interest rates elevated, which further stresses real estate markets and municipal finances.

The impact extends beyond businesses to reshape household economics. Individual housing insurance premiums in Utah have surged 52% since 2019. The repricing of risk due to wildfire threats is reshaping real estate markets, making homes in high-risk areas less desirable while increasing costs for rebuilding or retrofitting to meet new safety standards.

Recent disasters in Oregon and Maui offer concerning parallels. Oregon's landmark wildfire settlement has fundamentally reshaped utility policies, while Maui's $6 billion in damages demonstrated how quickly seemingly insulated economies can be disrupted. These events aren't just parallel crises—they're potentially interconnected pressure points in a regional economic system that's more fragile than previously understood.

Looking ahead, the key question isn't just how to maintain growth—it's how to build resilience against these interconnected risks. Traditional economic planning tools may not be sufficient for scenarios where climate risks, insurance market disruption, and migration patterns create complex feedback loops.

Key Takeaways

Economic Disruptions from Asset Repricing

The California wildfires, with estimated economic losses of $135–$150 billion, highlight the far-reaching impact of shifting asset values. Beyond physical damage, the loss of high-value properties and intangible assets is reshaping markets in ways that challenge traditional disaster recovery and economic planning models.Regional Market Pressures and Migration

Insurers exiting the California market and rising costs in energy, infrastructure, and borrowing are creating systemic feedback loops. These disruptions are pushing migration into neighboring states like Utah, which is already experiencing a 4.6% GDP growth rate and record population increases, amplifying economic and housing pressures across the Western U.S.Adapting to Interconnected Risks

The cascading effects of asset repricing, insurance market shifts, and regional economic pressures demand innovative strategies. Building adaptive resilience will be essential for Utah to sustain its growth while navigating these complex, interconnected challenges.

Are we entering a new cost floor? This doesn't even account for a surge in demand for construction and materials for reconstruction. Source: Do Good.