Article No. 1: Looking Around the Corner

Utah’s FY25 Revenue Estimates

The latest state revenue estimates reveal important trends for Utah's economy, impacting business strategic planning and forecasting. These estimates show:

Continued economic growth, albeit at a moderated pace.

An increase in state revenue, with a slight rise from previous projections, despite tax cuts.

A portion of the FY 2025 revenue was initially marked as "high risk," highlighting the unpredictability of economic forecasting.

Key Observations:

Utah’s economy continues to grow, supported by solid job growth and consumer spending. However, the pace is moderating following past federal interventions and market volatilities.

Consumer behavior is shifting back from goods to services, impacting sales tax growth and indicating changes in spending patterns.

Rising consumer and business debt levels signal potential challenges for state revenue and the broader economy.

Economic models face uncertainties due to past data's inadequacy in predicting future trends, compounded by changing consumer behavior and market conditions.

Implications for Business Leaders and Decision Makers:

The moderation in growth and highlighted uncertainties necessitate a strategic approach focusing on agility, risk management, and innovation.

Understanding these trends is crucial for navigating the current economic environment and leveraging opportunities for growth and resilience.

Leaders should monitor shifts in consumer spending, inflation trends, and lending practices to adapt their strategies accordingly.

Show Me The Money:

Current revenue estimates, from state sales and income tax only, are:

FY 2024 (July 2023 to June 2024): $11.48 billion

FY 2025 (July 2024 to June 2025): $11.85 billion

Since the last update in December 2023, both figures have slightly increased. However, the financial projections for fiscal year (FY) 2024 are somewhat lower than the actual revenues of FY 2023 and significantly lower than the initial forecasts for FY 2024 made back in December 2022. This reduction is mainly due to tax cuts enacted by the 2023 Legislature, which trimmed the projections by $500 million.

There's also an intriguing aspect to these estimates: in December, economists highlighted a $150 million portion of the FY 2025 forecast as "high-risk." This caution has proven warranted, as the sales tax revenue projections, deemed risky, dropped by $136 million between December and February. On a brighter note, income tax revenue projections rose by $262 million during the same period.

State revenue is growing, so is the economy.

The state budget has doubled in the past 10 years. In FY 2015, the budget (from all sources) was $13.5 billion. By FY 2024, it was $29.4 billion. Though federal funds have played a role, much of the growth is from sales and income tax: initial estimates for FY 2015 were $5.4 billion, compared to $11.8 billion in FY 2024.

The doubling of Utah's state budget over ten years, supported by the doubling of sales and income tax revenues, indicates a robust and expanding economy. This growth reflects a more significant economic base, higher consumer spending, and increases in population and employment rates, all of which contribute to a more robust state economy.

The significant rise in tax revenues suggests that businesses are thriving and individuals earn more, leading to higher tax collections. Moreover, the ability to double the budget without solely relying on federal funds demonstrates Utah's economic resilience and strength, highlighting its capacity to generate wealth and sustainably fund public services.

Growth was most pronounced in the past few years, between FY 2019 and FY 2023, when sales and income tax revenue grew 55% -- so fast that estimates couldn’t keep up, as seen in the gap between the line and the bars for some years in Figure 1. This record growth was due primarily to pandemic-related federal stimulus payments that increased personal incomes. Corporate incomes also grew from federal intervention; remember Paycheck Protection Program (PPP) loans? During this time, people changed their consumption habits, choosing goods over services while spending more time at home (and goods are taxed more highly than services).

Figure 1. Utah Revenue Estimates and Final Collections

Notes: Revenue to the General Fund and Income Tax Fund. Some estimates include allocations to the Economic Development Tax Increment Financing (EDTIF) fund and some do not. Certain estimates were updated in a subsequent month, in which case the later estimate is shown here. Declines between February and May estimates are generally due to legislative action, primarily tax cuts.

Source: Revenue estimates provided to the Utah State Legislature Executive Appropriations Committee. https://le.utah.gov/committee/committee.jsp?year=2024&com=APPEXE

In 2019, experts predicted Utah would collect less than $10 billion in state tax revenue by FY 2024. But now, they estimate the state will collect $11.48 billion, even with tax cuts. As a percentage, estimated state revenue is now 14.8% higher than pre-pandemic projections for the current year.

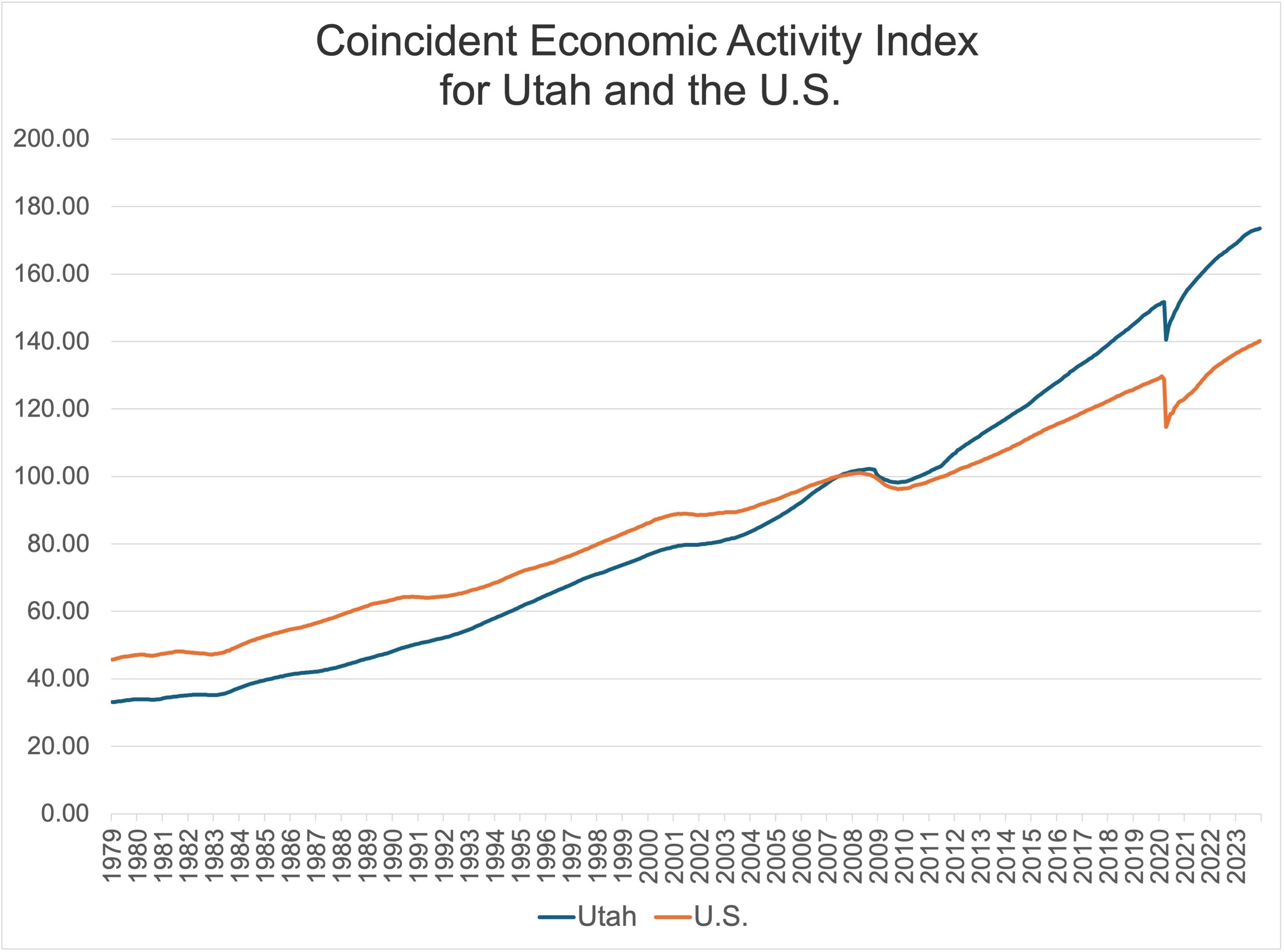

Powering this revenue is a standout economy. Utah is recognized as the best state economy in the nation and has exceeded national averages for over 15 years. The Federal Reserve’s Coincident Economic Activity Index, which tracks employment, unemployment rates, manufacturing hours, and wages, illustrates Utah's dynamic economic health. This index, alongside Utah's impressive gross state product trends (see Figure 5), showcases the state's strong job market, low unemployment, and competitive wages. These factors not only drive consumer spending and business investment but also significantly enhance state revenue through taxes. Utah's economic strategies have proven effective, fostering an environment that supports business growth and offers substantial opportunities for workers and entrepreneurs alike.

Figure 2. Coincident Economic Activity Index for Utah and the U.S.

Note: The Coincident Economic Activity Index includes four indicators: nonfarm payroll employment, the unemployment rate, average hours worked in manufacturing and wages and salaries. The trend for each state's index is set to match the trend for gross state product.

Source: Federal Reserve Bank of Philadelphia, Coincident Economic Activity Index for Utah [UTPHCI], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/UTPHCI

Beyond growth, many economic indicators are strong or improving as we look ahead. Unemployment in Utah is exceedingly low at 2.8% as of December 2023. Economists typically consider around 4% to be full employment. This can be a more challenging measure for employers but means job seekers are likely to secure employment, which contributes to consumer spending power.

There is a source of state revenue that rarely garners much attention but has been surprisingly impactful in this climate of high interest rates: investment income. State funds in bank accounts that are waiting to be spent are earning substantial returns (up 153% since last year!). Rates will surely decline in the future but that future is looking further away and in the meantime, the high yields on bank accounts are impressively lucrative.

There is chatter in the media (including The Wall Street Journal, The New York Times, The Atlantic, and others) about how negatively many people feel toward the economy, even as the indicators look positive. Consumer pessimism does not appear to be impacting spending, however – growth in spending even exceeds growth in wages, for Utah and the U.S.. While spending may not be sustainable given the wage data, it does point to better economic conditions than consumer sentiment implies.

Figure 3. Change in Utah Consumer Spending on Goods and Services Compared to Household Income

Source: U.S. Bureau of Economic Analysis, Per Capita Personal Consumption Expenditures: Services for Utah [UTPCEPCSRV], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/UTPCEPCSRVhttps://d36oiwf74r1rap.cloudfront.net/wp-content/uploads/2024/01/UI2024.pdf. Page 17

In Utah consumer pessimism persists, with sentiment well below pre-pandemic levels, but it is notably higher than for the nation as a whole

Figure 4. Consumer Confidence for Utah and the U.S.

Sources: University of Michigan Surveys of Consumers and Kem C. Gardner Policy Institute

Overall, predictions for state revenue underscore a positive outlook for the present and future of Utah’s economy.

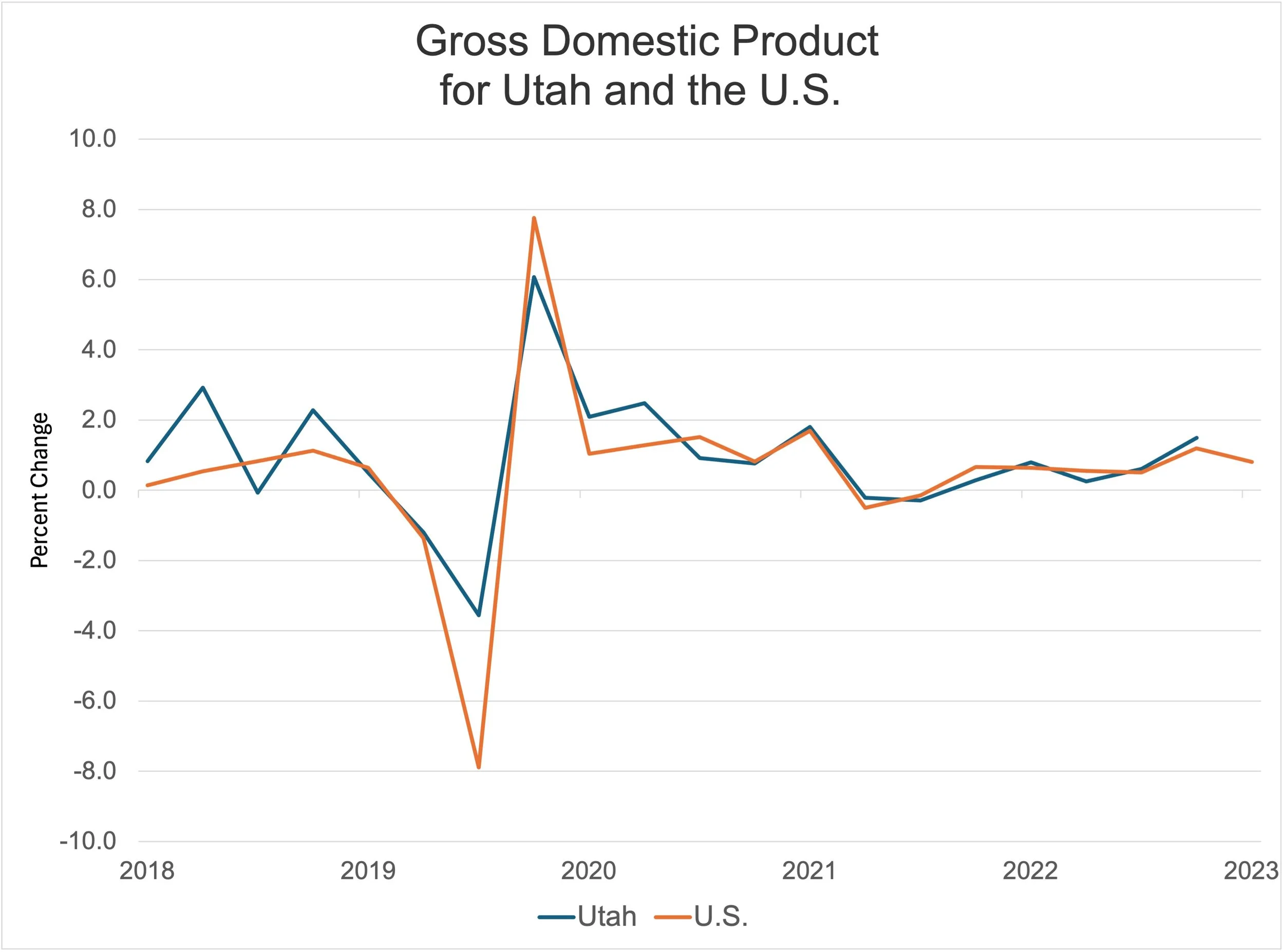

State revenue is moderating from recent years; so is the economy.

State revenue growth is becoming more modest compared to recent years, mirroring the broader economy's shift. This moderation was anticipated by state economists, given that the federal support provided during the pandemic to individuals and businesses was not meant to last indefinitely. The trend depicted in Figure 1 highlights a return to more stable, albeit slower, growth after the explosive expansion seen in previous years. (The noticeable dip in revenue projections between February and May for fiscal year (FY) 2024 is attributed to tax reductions.) This deceleration in revenue growth suggests the economy is stabilizing after a period of intense fluctuation, akin to a wave that has reached its peak and is now rolling along.

Figure 5. Gross Domestic Product for Utah and the U.S.

Note: Real gross domestic product is the inflation adjusted value of the goods and services produced by labor and property located in the United States and Utah. Percent change is quarterly. Rates are seasonally adjusted.

Source: U.S. Bureau of Economic Analysis, Real Gross Domestic Product [GDPC1], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/GDPC1

Signs of moderation are becoming evident in labor markets. Employment is still on the rise, yet the pace of growth has slowed compared to the rapid increases seen in recent years. Similarly, wages have been growing robustly, even outstripping inflation over the last year, but this growth is starting to decelerate. As for inflation itself, after reaching a peak in 2022, it began to fall quickly but has recently stabilized at around 3%—still above the Federal Reserve's ideal target of 2%. These indicators, which previously signaled a strong and improving economy, are now showing a slight retreat from their prior advancements.

Figure 6. Employment Rate for Utah

Note: Nonfarm employment

Source: Utah Department of Workforce Services, Workforce Research and Analysis

The slowdown in state revenue growth is shedding light on a shift in consumer behavior (see Figure 3). Pre-pandemic, there was a noticeable trend of people spending more on services and less on goods, which posed a challenge for Utah due to the state's reliance on sales tax from goods more so than services. This concern led Utah leaders to initiate significant tax reform in 2019, although it was later repealed. During the pandemic, consumer preferences swung back towards goods, driven by more time spent at home and limited access to or interest in services—illustrated by people buying products like Flowbees instead of going out for haircuts. Now, this trend is reversing once again, moving back towards services.

Additionally, recent Consumer Price Index data indicates that while inflation for goods is stabilizing, it continues to rise for services. This ongoing shift could significantly impact sectors more aligned with goods than services, marking a notable change in the economic landscape.

While consumer spending patterns are evolving, the total amount of money being spent continues to rise. This trend is evident from the data showing that consumer debt has reached unprecedented levels. Despite strong spending being a major force driving the economy, this trajectory raises concerns about sustainability. During the pandemic, people benefitted from federal stimulus checks and, with limited options for spending, many increased their savings. However, as wage growth has slowed, consumers have continued to spend, dipping into their savings and increasingly turning to debt to fund their purchases. While mortgages remain the most significant form of debt, credit card debt is on the rise. This mounting debt poses a threat to both state revenue and the broader economy. If debt levels reach a point where consumers are unable to take on more to support their spending habits, there could be a significant downturn in consumer spending.

Figure 7. Total Non-Housing Debt Balance for U.S. Consumers

Source: Federal Reserve Bank of New York, Household Debt and Credit Report, 2023 Q4

Businesses, particularly smaller ones, are starting to feel the pinch of debt much like individual consumers. Large corporations have so far navigated the high-interest environment relatively unscathed, thanks to their earlier issuance of bonds at lower rates and capitalizing on high yields from accounts. However, the real challenge for these behemoths looms on the horizon as they approach the need to refinance at today’s steeper rates. On the other hand, smaller businesses are already grappling with the immediate effects of higher borrowing costs and ballooning credit card debts, mirroring the financial strain faced by consumers.

This increasing business debt not only affects corporate income tax revenues—which, although more unpredictable and a smaller slice of the revenue pie than personal income taxes, still play a crucial role—but has broader implications for economic expansion. The picture of this moderating economy is darkened by banks’ growing reluctance to lend. Credit is the lifeblood that enables both individuals and businesses to invest and generate more wealth. A contraction in lending will inevitably reflect in reduced income tax collections, as both personal and business investments dwindle.

Moreover, the reluctance of banks to extend credit, compounded by the hesitance of individuals and businesses to seek loans due to high interest rates, forms a double-edged sword that could severely constrain economic growth. This lack of available capital restricts the economy's potential for expansion, underscoring the intertwined fate of business health, consumer spending, and the broader economic outlook.

There is uncertainty.

The forecast for fiscal year (FY) 2025 includes $11.85 billion in new revenue, with state economists originally marking $150 million of that as "high risk." While uncertainty is a normal part of revenue estimates, the explicit labeling of a portion as high risk underscores the notable level of unpredictability surrounding these projections. This unusual step highlights the complexities in making accurate predictions in the current economic climate.

The reliability of economic models, which are integral to these forecasts, is challenged due to their dependence on historical data. The recent economic landscape, shaped by federal stimulus funds, changing consumer habits, and volatility in the housing and stock markets, has proven to be a poor predictor of future trends. The discrepancies observed between forecasts and actual collections, especially the overachievement in FY 2021 and FY 2022 followed by a slight deficit in FY 2023, exemplify the difficulty in using past data to predict future outcomes.

Compounding the challenge is the unusual behavior of economic indicators, such as the disconnection between low unemployment rates and falling inflation, which defies traditional expectations. The future effects of interest rate adjustments, how businesses and consumers will navigate increasing debt, and shifts in economic preferences add layers of uncertainty. This complex web of factors makes the economic outlook particularly difficult to gauge.

Given this backdrop of uncertainty, it's understandable that consumers might be feeling pessimistic. Their apprehension reflects the broader, unpredictable economic environment, suggesting their concerns are not unfounded.

What should business leaders do with this information? Moderation and Maturity.

Understanding the nuances of state revenue estimates can offer valuable insights into the Utah economy's current state and future trajectory. These estimates not only reflect the immediate fiscal health of the state but also serve as a barometer for broader economic trends, consumer behavior, and business climate. For business leaders, interpreting what these figures imply about Utah's economy is crucial for strategic planning and decision-making.

The moderation in state revenue growth signals a transition period for Utah's economy, moving from the rapid expansion fueled by federal interventions and pandemic-related volatilities to a more sustainable pace of growth. This shift suggests a maturing economy that, while still robust, is normalizing after years of exceptional growth rates. Business leaders should see this as an indicator of stability, but also as a prompt for cautious optimism.

This moderation, coupled with the highlighted uncertainties, underscores the importance of agility and adaptability in business strategies. Leaders should consider how their businesses can remain resilient in the face of economic fluctuations, leveraging strengths such as Utah's strong labor market and ongoing consumer spending, while being mindful of potential challenges like inflation and changing spending patterns.

Ultimately, state revenue estimates provide a snapshot of Utah's economic landscape, offering clues on consumer confidence, spending habits, and the overall business environment. For business leaders, these insights can guide strategic decisions, from investment and expansion to innovation and diversification. By understanding and responding to these economic indicators, businesses can not only navigate the present landscape more effectively but also position themselves to capitalize on future opportunities in Utah's dynamic economy.